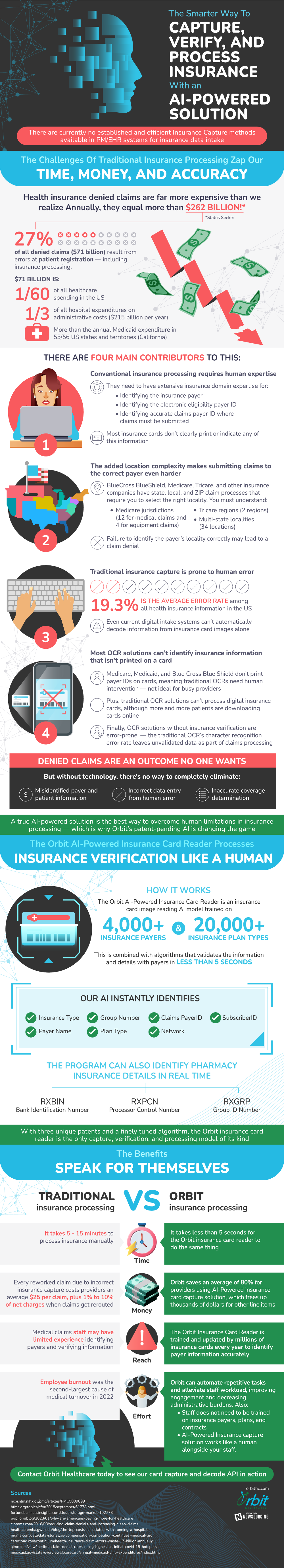

There are currently no optimal methods for insurance data intake. In an industry so important to our society, the methods for processing are outdated and inaccurate. Not only that, but the processes are inefficient and error prone, costing insurance companies over $260 billion collectively per year.

There are many contributors to these problems, much of which stem from human intervention. Most current solutions for insurance processing cannot identify any insurance information that is not printed on a card. When technology can no longer assist, humans are forced to step in and complete the job. Some insurance companies, like Medicare, Medicaid, and Blue Cross Blue Shield, do not print payer IDs on cards. This is not ideal for busy providers, and requires even further human intervention. When humans become an integral part of this process, the chance and likelihood of error skyrockets. Among all health insurance information in the United States, the average error rate is 19.3%. These issues in combination with location complexity of each insurance provider makes it increasingly difficult to successfully capture and process insurance.

Because of these drawbacks, experts are working on a more modernized and efficient solution to insurance card processing using artificial intelligence. This technology can be trained to identify thousands of insurance payers and tens of thousands of plan types. Not only can AI identify more than the current solutions, but it can do it at a much faster pace and with more accuracy than ever before. The benefits to adopting this emerging technology are clear, leading many industry leaders to start to make the switch.

Source: OrbitHC

SME Paid Under